Today’s Sound Money Musings blog is a guest blog by Maine State Senator Jim Libby, with his Message to the Maine Legislative Council on January 30, 2023 regarding Legislative Resolution 577, entitled “Joint Resolution, Urging Congress to Limit The Federal Reserve’s Ability to Expand the Money Supply”.

Mr. President, Madam Speaker, and Esteemed Members of the Legislative Council,

My name is Jim Libby, and I am a State Senator representing Senate District # 22, comprised of the towns of Naples, Sebago, Baldwin, and Standish in Cumberland County; Hiram and Porter in Oxford County; and, Limington, Limerick, Cornish, Parsonsfield, Newfield, Acton, and Shapleigh, in the County of York.

It is my honor to bring to your attention the contents of L.R. 577, JOINT RESOLUTION, URGING CONGRESS TO LIMIT THE FEDERAL RESERVE’S ABILITY TO EXPAND THE MONEY SUPPLY.

Not only am I a State Senator, but I am also an economist. I analyze economic circumstances and give speeches around the state in my role as a business professor at Thomas College and a visiting economics professor at Colby College. But it was more than just my profession that caused me to submit this Joint Resolution that we speak of today. My constituents have told me, in a large majority – Republican, Democrat, and unenrolled individuals – that the government has to stop printing money. The people of Maine understand that there is a problem.

A stable currency is the most important underlying factor to a healthy economy in any country on any continent. World-wide, poor money supply expansion decisions have brought entire countries to their knees. Rapid money supply expansion has severe destabilizing effects on economies.

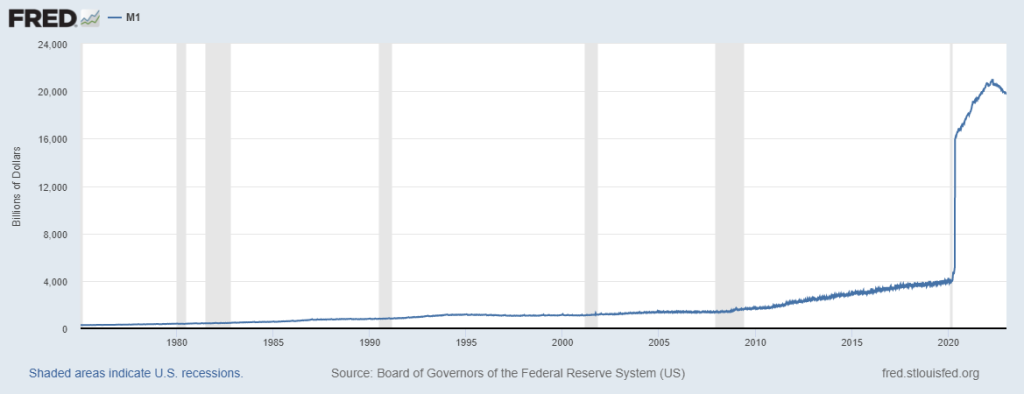

Please consider the following graph from the Federal Reserve Bank of St. Louis:

Here at home, money has changed recently. A supply shift has caused a redenomination of the dollar. The graph above shows the expansion of the Money Supply by the Board of Governors of the Federal Reserve System, through the actions of the Federal Open Market Committee. As you can see, the level of “M1,” which represents cash and near cash items has been expanded by the Federal Reserve System by as significant amount. In fact, on January 13, 2020 the level of M1 was $3,847.1 trillion dollars. Since that date, M1 has increased by 412% to $19,735.4 trillion. If all other parts of the American economy were held constant, including product/service demand and supply side issues, supply chain disruptions, market elasticities, labor shortages, and all other inputs into the calculus, we can expect prices to increase by 412% from that date as well. In short, the amount that the dollar has been devalued since the beginning of 2020 is at a factor of four. There has been a great redenomination.

Money supply expansion policies undertaken during the Great Recession pale in comparison to what occurred in response to the Covid-19 pandemic. As you know, easy money policies drive interest rates down during difficult times. This market action is considered by many in my field to be pro-consumer. It is also pro-bank. I will return to that issue later in this letter.

Money supply expansion can assist an economy in the short run by helping to bring an economy back to what is known by some in the field as the full employment equilibrium. Printing more money, for example, means that it takes more dollars to buy a share of stock. So, we all saw the stock market soar during the pandemic. I was surprised when people wondered why.

Unfortunately, heavy currency expansion for extended periods can also damage an economy, cutting the buying power of peoples’ wages. According to most economists, wages are “sticky.” They tend to not change much and are slow to rise. They are often based on contractual relationships and other factors that cause them not to rise in unison with the prices of products and services. In short, a weaker dollar buys less goods for all of us following currency expansions, and when this is persistent, families are profoundly affected.

Today we face severe consequences. There is a steeper wedge that has been driven between the “haves” and the “have-nots.” People can’t afford rents. A large number of families no longer qualify for a mortgage at certain income levels. Seniors who are on a fixed income have received an increase in Social Security payments that represents only a fraction of inflation. Unskilled, semi-skilled, and even the highly skilled workers cannot pay for spikes in housing, food, energy, transportation, you name it. Institutions such as state minimum wages have been robbed of their former effectiveness. Employers struggle mightily to pay wages. State lawmakers are forced to declare emergencies and send out band-aid style checks that do little to address the underlying problem of inflation.

By way of example, I recently visited the Southern Maine Medical Center, only to be told by their CEO that input costs have far outstripped their ability to access needed labor levels and technical inputs. State payment systems such as Medicaid have increased, but not nearly at the rate of present-day inflation, leaving hospitals to consider unsafe cuts and reorganization in the wake of the cost increases.

Inflation in the U.S. has not been transitory as promised by the current Chair of the Federal Reserve, Jerome Powell. He has withdrawn his statement of the “transitory” nature of inflation, and the issue has since been dropped. No matter how one looks at the problem of inflation, actions of the Federal Reserve are a root cause.

Congress borrows and bonds heavily, which contributes to the inflationary problem, but Congress answers to voters. The members of the Federal Reserve System (the Fed) are appointed individuals who are shielded from many of those pressures once they are appointed. The Fed Chair needs only to report to Congress about actions they are engaged in.

There clearly needs to be a limit to the power of the Fed to expand M1. Since the Federal Reserve was created in 1913, it has accumulated more and more power, particularly due to marginal changes in law that came with the Great Depression and periodic recessions that followed. Exploring potential limits to expansion (and contraction) of the money supply is something that will protect all citizens. I propose through a Joint Resolution that we urge Congress through our Maine Congressional leaders to introduce legislation that would create a study commission to specifically examine methods to limit changes in the money supply that originate with the Fed. Minimum and maximum thresholds and other actions have the potential to shield Maine families from national policies that favor banking institution profitability over consumer purchasing power and savings ability. It is a fact that most leaders in the Federal Reserve System are career bankers.

The power of the Federal Reserve System has become akin to a fourth federal branch of government. In fact, the System wields so much financial power that the other three branches of government are thought by some field experts to be of lesser consequence. We have all heard that the most powerful person in the world is not the President of the United States. Instead, it is the Chair of the Federal Reserve System. While this point is debatable, there is plenty of evidence to support such a conclusion.

A specific example can be offered to support previous statements. The U.S. economy is currently in a condition in which yields for bank certificates of deposits (CD) result in negative real interest rates. Over the past several months, 4% rate of return to a customer whose goal is savings growth is eroded by a 7% inflation rate, leaving a negative 3% simple rate of return. In years previous to the pandemic, the numbers were closer to .5% and 2.5%. Either way, money is not working for citizens. The accumulation of savings is affected by banks and shadow banking institutions’ lending practices under current market conditions. The “store of value” function of currency has been tapped. This must be stopped before families experience more catastrophic impacts.

There are hundreds of other similar examples of the negative impact of money redenomination by central banks. It is imperative that Maine speaks as one, since we live in a state where there is a disproportionate impact to inflation. According to the U.S. Census Bureau, median household income in Maine are below the national average, at $63,182 for the most recent full-year survey (2021). Costs are high in Maine. A recent U.S. News and World Report study ranks Maine 35th among states for affordability.

These factors and others put Maine in a position to experience more negative effects to inflation than the rest of the nation. We must act, and we must act now, to bring conditions of decision making at the Federal Reserve to be more in line with the challenges experienced by families attempting to spend an ever-weaker dollar.

Upon approval of L.R. 577, I will quickly move to provide the Reviser’s Office with these and other important facts that support the joint resolution.