Author G. Edward Griffin’s 16-Step Plan for Eliminating the Federal Reserve and Restoring Sound Money to Our Nation

Repeal the legal-tender laws. The federal government will continue accepting Federal Reserve Notes in the payment of taxes, but everyone else will be free to accept them, reject them or discount them as they wish. There is no need to force people to accept honest money. Only fiat money needs the threat of imprisonment to back it up. Private institutions should be free to innovate and to compete. If people want to use Green Stamps or Disney-ride coupons or Bank-of-America Notes as a medium of exchange, they should be free to do so. The only requirement should be faithful fulfillment of contract. If the Green-Stamp company says it will give a crystal lamp for seven books of stamps, it should be required to do so. Disney should be required to accept the coupon in exactly the manner printed on the back. And, if Bank of America tells its depositors they can have their dollars back any time they want, it should be required to keep 100% backing (coins or Treasury certificates) in its vault at all times. In the transition to a new money, it is anticipated that the old Federal Reserve Notes will continue to be widely used.

Freeze the present supply of Federal Reserve Notes, except for what will be needed in step number six.

Define the “real” dollar in terms of precious-metal content, preferably what it was in the past: 371.25 grains of silver. It could be another weight of silver or even another metal, but the old silver dollar is a proven winner.

Establish gold as an auxiliary monetary reserve which can be substituted for silver, not at a fixed-price ratio, but at whatever ratio is set by the free market. Fixed ratios always become unfair over time as the price of gold and silver drift relative to each other. Although gold may be substituted for silver at this ratio, it is only silver that is the foundation of the dollar.

Restore free coinage at the U.S. Mint and issue silver “dollars” as well as gold “pieces”. Both dollars and pieces will be defined by metal content, but only coins with silver content can be called dollars, half-dollars, quarter-dollars or tenth-dollars (dimes). At first, these coins will be derived only from metal brought into the Mint by private parties. They must not be drawn from the Treasury’s supply which is reserved for use in step number seven.

Pay off the national debt with Federal Reserve Notes created for that purpose. Creating money without backing is forbidden by the Constitution; however, when no one is forced by law to accept Federal Reserve Notes as legal tender, they will no longer be the official money of the United States. They will merely be a kind of government script which no one is required to accept. Their utility will be determined by their usefulness in payment of taxes and by the public’s anticipation of having them exchanged for real money at a later date. The creation of Federal Reserve Notes, with the understanding that they are not the official money of the United States, would therefore not be a violation of the Constitution. In any event, the deed is already done. The decision to redeem government bonds with Federal Reserve Notes is not ours. Congress decided that long ago, and the course was set at the instant those bonds were issued. We are merely playing out the hand. The money will be created for that purpose. Our only choice is when: now or later. If we allow the bonds to stand, the national debt will be repudiated by inflation. The value of the original dollars will gradually be reduced to zero while only the interest remains. Everyone’s purchasing power will be destroyed, and the nation will die. But if we want not to repudiate the national debt and decide to pay if off now, we will be released from the burden of interest payments and, at the same time, prepare the way for a sound monetary system.

Pledge the government’s hoard of gold and silver (except the military stockpile) to be used as backing for all the Federal Reserve Notes in circulation. The denationalization of these assets is long overdue. At various times in recent history, it was illegal for Americans to own gold, and their private holdings were confiscated. The amount which was taken should be returned to the private sector as a matter of principle. The rest of the gold supply also belongs to the people, because they paid for it through taxes and inflation. The government has no use for gold or silver except to support the money supply. The time has come to give it back to the people and to use it for that purpose.

Determine the weight of all the gold and silver owned by the U.S. government and then calculate the total value of that supply in terms of real (silver) dollars.

Determine the number of all Federal Reserve Notes in circulation and then calculate the real-dollar value of each one by dividing the value of the precious metals by the number of notes.

Retire all Federal Reserve Notes from circulation by offering to exchange them for dollars at the calculated ratio. There will be enough gold or silver to redeem every Federal Reserve Note in circulation.

Convert all contracts based on Federal Reserve Notes to dollars using the same exchange ratio. That includes the contracts called mortgages and government bonds. In that way, monetary values expressed within debt obligations will be converted on the same basis and at the same time as currency.

Issue Silver Certificates. As the Treasury redeems Federal Reserve Notes for dollars, recipients will have the option of taking coins or Treasury Certificates which are 100% backed. These Certificates will become the new paper currency.

Abolish the Federal Reserve System. It would be possible to allow the System to continue as a check clearing-house, so long as it did not function as a central bank. A check clearing-house will be needed, and the banks that that presently own the Fed should be allowed to continue performing that service. However, they must no longer receive tax subsidies to operate, and competition must be allowed. However, the Federal Reserve System, as presently chartered by Congress, must be abolished.

Introduce free banking. Banks should be deregulated and, at the same time. cut loose from protection at taxpayers’ expense. No more bailouts. The FDIC and other government “insurance” agencies should be phased out, and their functions turned over to real insurance companies in the private sector. Banks should be required to keep 100% reserves for demand deposits, because that is a contractual obligation. All forms of time deposits should be presented to the public exactly as CDs are today. In other words, the depositor should be fully informed that his money is invested and he will have to wait a specified time before he can have it back. Competition will insure that those institutions that best serve their customers’ needs will prosper. Those that do not will fall by the wayside – without the need of an army of bank regulators.

Reduce the size and scope of government. No solution to our economic problems is possible under socialism. It is the author’s view that the government should be limited to the protection of life, liberty and property – nothing more. That means the elimination of almost all of the socialist-oriented programs that now infest the federal bureaucracy. If we hope to retain – or perhaps to regain – our freedom, they simply have to go. To that end, the federal government should sell all assets not directly related to the primary function of protection; it should privately sub-contract as many of its services as possible; and it should greatly reduce and simplify its taxes.

Restore national independence. A similar restraint must be applied at the international level. We must reverse all programs leading to disarmament and economic interdependence. The most significant step in that direction will be to Get us out of the UN and the UN out of the US, but that will be just the beginning. There are hundreds of treaties and administrative agreements that must be rescinded. There may be a few that are constructive and mutually to us and other nations, but the great majority of them will have to go. That is not because we are isolationist. It is simply because we want to avoid being engulfed in global tyranny.

SOURCE: The Creature from Jekyll Island: A Second Look at the Federal Reserve by G. Edward Griffin. Fourth Edition. Pages 573-577. Order HERE

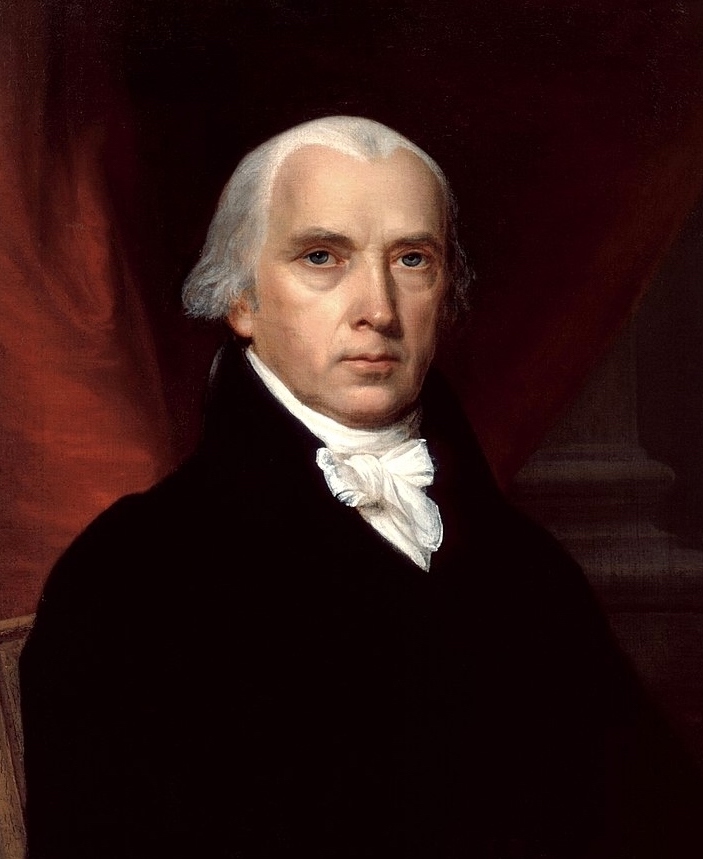

“If Congress can employ money indefinitely…the powers of Congress would subvert the very foundation, the very nature of the limited government established by the people of America.”

James madison